Transferring Cash Balance From Investment Accounts In Quicken For Mac 2016

Simplifies Managing and Paying Bills for Mac and Windows Users MOUNTAIN VIEW, Calif.--(BUSINESS WIRE)--, now available from. My passport for mac 1tb setup. (Nasdaq: INTU), includes new features for Mac and Windows users that are designed to further help today’s busy consumer easily track, transact and take control of managing their money. For more than 30 years, individuals and families have counted on Quicken, a top personal money management software program, to help them achieve their financial goals. Here’s what’s new for Quicken 2016: Quicken 2016 for Windows • In addition to managing multiple financial accounts in one location, customers can now see, track and pay all of their bills in one place. After users link their bills, Quicken automatically tracks due dates and amounts due, eliminating the need to log into multiple accounts to stay on top of their bills. Quicken users can easily pay bills using Quicken Bill Pay.

Quicken 2016 for Mac • Responding to customer requests, the new Quicken for Mac includes integrated bill pay. This lets users easily pay their bills, transfer money between accounts, see what bills have been paid, and which are coming or are past due so they can manage cash flow.

Daniel Goldsmith, a 22-year Quicken for Mac customer and beta tester from Boynton Beach, Fla., said, “Quicken 2016 for Mac continues to improve an already iconic product with new enhancements that allow me to easily move forward with all of my accumulated data in a modern product.” With a focus on delivering an exceptional customer experience, Quicken has expanded customer support in the United States and improved the reliability and accuracy of bank downloads and transactions. Quicken has also grown the product development team to build out the next generation of Quicken features.

“We’re working harder and smarter than ever to delight customers,” said, senior vice president and general manager of Quicken. Using mac for karaoke youtube. “Quicken 2016 affirms our commitment to listening to our customers and helping them achieve financial success at every life stage.

Quicken makes it easy to set up and use cash accounts, and you can transfer funds to and from these accounts and others. What a Cash Account Is and Why You Need One Having a cash account allows you to compartmentalize your money. Quicken has over a dozen different account types you can select when you initially create an account, but it limits what kinds of account types you can change afterward.

Our new features for Mac and Windows users help remove some of the complexity around managing and paying bills. Looking ahead, our goal is to add capability and enhancements to Quicken products that extend the ability for users to easily manage their money across devices.” Features Users Have Come to Count On In addition to connecting to more than 14,500 checking, savings, credit card, loan, investment and retirement accounts, Quicken will continue to help users: • Easily manage more complex financials, such as investments, retirement and tax planning • Understand their credit with access to a free quarterly credit score and credit report summary, powered by Equifax. This feature is available for Windows only. • Make smart money decisions on-the-go with the free mobile companion app for iPhone, iPad, iPod Touch and Android devices. • Manage bills directly from the Quicken register. • Receive timely alerts and bill reminders such as low balance, over budget and unusual activity. • Set up and track budgets for variable monthly or seasonal expenses, such as entertainment, dining out or holiday shopping.

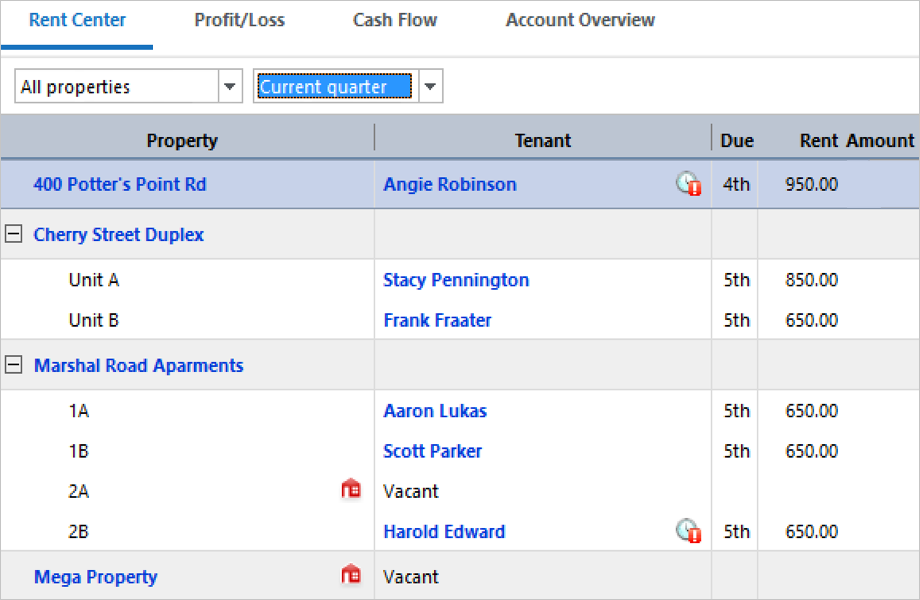

• Create savings goals to help track progress toward specific targets, such as building an emergency fund or paying down debt. This feature is available for Windows only. Pricing and Availability The Quicken product line for 2016 is available now at Quicken.com and at select retailers. Its products serve individuals, business owners and property managers and include: •: For easy money management and bill pay. $74.99 •: For simple money management needs; helps individuals get organized and learn how to budget. •: For increasing savings; helps create custom budget, savings and debt reduction plans. •: For managing investments; helps plan for tax time.